What Is Claims Processing?

Claims processing is the series of steps insurance companies follow to review, verify, and settle claims from policyholders.

It includes checking claims for accuracy, confirming coverage, and deciding on payment amounts. This process is crucial for keeping the promises made to policyholders and keeping customer trust.

Traditionally, the insurance claims process takes a lot of time and effort. But with insurance workflow automation handling repetitive tasks, the process runs smoother, resources stretch further, and customers enjoy faster, better service.

What Are the Key Steps in the Insurance Claim Process?

When a client submits a claim – be it for home repairs, car damage, or medical expenses – there’s a process in place to make sure it’s handled right. Here we break it down into five claim processing steps:

1. Receiving the Claim

The claims process begins the moment a client reports an incident to their insurance agent. This could be anything from storm damage to a car accident, or in the case of health insurance, a hospital visit.

The first person who handles the claim opens a file and requests the following details:

- A description of what happened

- The type of incident

- Photos of any damage

- A police report, if there is one

This information helps the team choose the best adjuster for the next steps.

2. Investigating the Claim

The adjuster steps in to assess the details of the incident and document the extent of the damage. They’ll visit the site – whether it’s a home, car, or other property – and note exactly what was damaged in the incident. At this point, they try to distinguish between damage caused by the incident and any pre-existing issues.

They also look at what’s covered under the client’s policy. For example, roof leaks from a recent storm might be covered, but older hail damage might not. If negligence is involved, the claim might not qualify for coverage.

3. Reviewing the Policy

Each policy has its own rules about what’s covered. Before estimating repair costs, the adjuster’s findings are checked against the client’s policy to confirm what’s eligible for reimbursement. This way, everyone’s on the same page about what’s covered and what isn’t.

4. Evaluating the Damage

The company needs a clear repair cost estimate to settle a claim. This often means consulting an expert – a mechanic for cars or a contractor for home repairs – who can provide a realistic cost breakdown. These professionals provide reliable numbers based on their experience.

The company may also offer the client a list of recommended vendors to handle the repairs, though clients are free to choose their own.

5. Resolving the Claim

In most cases, the insurance claim process wraps up once the client receives their payment. Depending on the situation, payment might go straight to the repair vendor or directly to the client. If the claim turns out to be invalid or fraudulent, it may be closed without payment.

Simplify Your Insurance Claims Process with Fluix: Start Automating Today

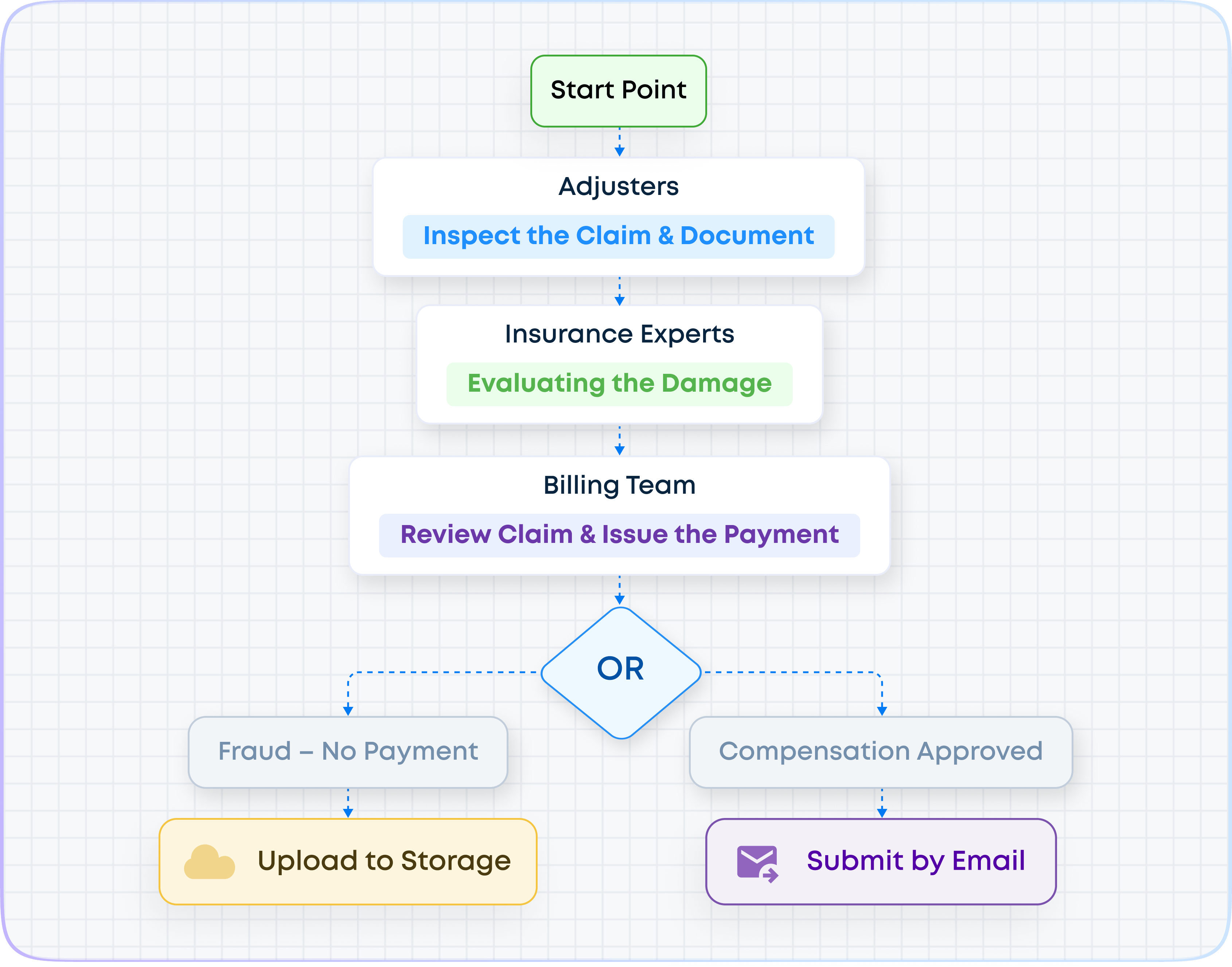

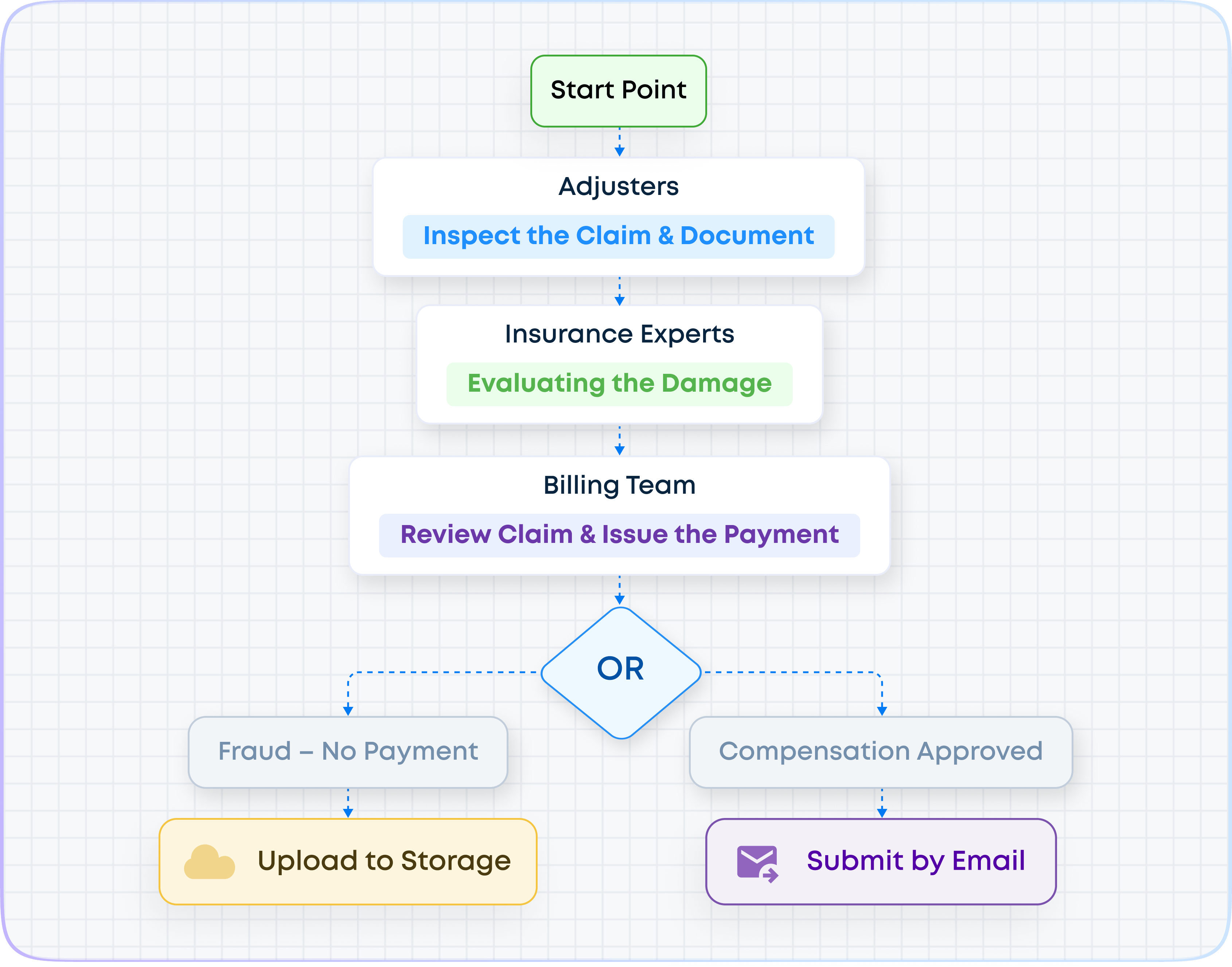

Claims Process Flowchart

Here’s the standard claims process flow, laid out to keep each stage clear and on track:

- Confirm you’ve received the claim

- Ask the client questions about what happened

- Assign an adjuster to look into the incident

- Determine liability and what the policy covers

- Bring in specialists to evaluate repair costs

- Recommend trusted vendors to handle repairs

- Send payment to the appropriate person or company

Workflow automation software can be useful here. It can automatically assign and schedule claim investigation, provide adjusters with relevant policy information, and guide them through the required steps to ensure a thorough investigation.

To cover aspects of the insurance claims process, we recommend using these checklists:

How to Optimize and Streamline the Insurance Claims Process

Making the claims process faster and easier doesn’t happen overnight, but insurers can use a few key strategies to help things run smoothly and keep customers happy. Here are some of the most effective ways to do it:

- Automate Routine Tasks: Many claims involve a lot of repetitive tasks, like data entry or checking documents. By using robotic process automation in insurance, companies can handle these tasks faster and with fewer errors.

- Strengthen Fraud Detection: As fraud tactics continue to change, insurers face an ongoing challenge to catch fraudulent claims. Advanced analytics and machine learning can scan claims for red flags, helping insurers identify fraud without slowing down honest claims. This keeps costs down and helps maintain customer trust.

- Use Digital Platforms for Customer Service: Giving customers the option to file and track claims through digital platforms, like mobile apps or online portals, makes the process easier for them and reduces the workload for customer support. These tools make self-service possible, which speeds up the process and boosts satisfaction.

- Integrate Data from Multiple Sources: Claims data comes from all over—customer records, public databases, third parties, and more. Data integration tools pull all this information together in one place, making it easy to access and cutting out repetitive work.

- Predictive Analytics for Cost Management: With predictive models, insurers can get a better sense of which claims might end up costing more. This lets them allocate reserve funds wisely and stay prepared for spikes during events like natural disasters.

- Move to Cloud Solutions: Cloud-based systems allow insurers to scale quickly, update easily, and support remote work. They improve data security, reduce infrastructure costs, and make sure the claims process can adapt to new demands.

Want to see the benefits of cloud-based workflows in action? Check out this insurance workflow case study and see how it helped Zurich Insurance drastically improve their productivity.

Managing the Insurance Claims Process with Fluix

Streamlining the insurance claims process doesn’t mean cutting corners. Many insurance companies are now using technology to keep employees productive, reduce human error, and resolve claims faster. Technology like Fluix.

Fluix is field productivity software that keeps claims management efficient and organized from start to finish. Here’s how:

- Document Management: You can securely log and store insurance claim forms digitally. Adjusters, underwriters, and claims handlers have instant access to the data they need, making retrieval quick and easy.

- Automated Workflows: Every claim moves through a guided, automated path in Fluix, from start to finish. This structure keeps each claim aligned with compliance standards, while helping prevent delays and keeping processes running smoothly.

- Field Inspection: Fluix’s mobile-first design lets field agents capture photos, complete inspection forms, and upload them on-site. This real-time upload means there’s no waiting to get essential data back to the team, cutting delays and helping claims move faster from verification to resolution.

- Real-Time Claims Tracking: Fluix’s live dashboards show the progress of each claim as it moves through the process. With visual updates on deadlines, reviews, and any bottlenecks, everyone stays updated without needing to check in constantly.