All around the world, accounting is one of the most heavily regulated fields. The larger the company, the stricter the accounting requirements. However, even small companies get their fair share of audits. Proper document management for accounting ensures that the financial department meets standard requirements and can easily access electronic financial records for audits, litigation and internal reasons.

What Is Document Management for Financial Institutions?

Few industries can hope to generate as many files and as much paperwork as financial institutions. These include banks, accounting firms and wealth management agencies. Document management refers to the process of tackling the generation, organization, protection and storage of files. Most financial institutions have built-in procedures to handle this, but these systems are often inefficient.

Here are some of the financial documents accounting teams and financial institutions need to manage:

- Customer records

- Employee records

- Bank statements

- Tax records

- Invoices and bills

- Receipts

How Can Organizations Improve Document Management?

Document management is one of the biggest challenges organizations of all sizes face. Luckily, over the years, business managers have found some best practices worth considering.

- Leverage Technology

Technology has come a long way since the original days of manually organizing Windows files. Companies should leverage new technology to make work easier for employees. Technology can make it possible to better organize and protect files, so you never lose another document again.

- Train Workers

Some workers have an intuitive relationship with technology. Give them virtually any device or software and they can make sense of it all in minutes. Even so, you can ensure effective use and a shorter learning curve by providing proper training. This also reduces errors and improves time efficiencies.

- Digitize Old Records

Some companies jump headfirst into digitizing the upcoming documents generated within the company. However, they never quite get around to digitizing the old records. Schedule the time to begin the process of uploading this information to your document management system. Eliminate the inefficiencies associated with information silos.

- Destroy or Store Old Records

After a company digitizes its records, it must decide what to do with the physical copies. Companies that choose to store the records must find a secure location. When companies choose to discard the old records, it’s important to follow proper protocol to ensure the documents are shredded or otherwise properly destroyed.

Automation for Audit Process Flows

How electronic forms and automated data capture help follow accounting protocols more easily

What Are Good Features To Look For in a Document Management System?

When looking for the best financial or procurement management software be selective. Consider which features on this list are important for your business and find software that meets all of them.

- Digitization

You need software that makes it easy to turn manual tasks into digital actions. For example, instead of filling out paper invoices, the software should make it easy to create, edit and store electronic copies. Similarly, when accountants receive physical paperwork, it should be easy to create electronic copies.

- Integration

Financial documentation software works best when it integrates with existing accounting and invoicing software. This reduces the need to move from app to app. It is yet another way that document management software eliminates inefficiencies caused by information silos.

- Storage

Storing physical files creates serious risks for businesses. Physical files are more susceptible to being misplaced or destroyed. Companies also lose a significant portion of real estate to store these files. Document management software with cloud services provides a much better solution.

- Search

The finance team often needs to review specific employee records, invoice numbers or transactions. Good search functions make it easy to find this information with a simple click. The search should pull up more than just files of the same name. It should also search the content of files. Additionally, it should have a filter setting to make it easy to search via factors, such as size or date created.

- Protection

Not everyone should have access to all financial records. Consequently, companies need to invest in document management that assigns different levels or types of authorization to different users. This includes not just different types for workers but also customers versus workers.

- Tracking

The financial department handles some of the most confidential files in the organization. Consequently, knowing who accessed and edited what and when is crucial to ensuring proper record management and accountability.

- Signatures

The accounting department often needs to create, collect and store electronic and wet signatures. Financial professionals also need to sign off on invoices or have powers of attorney to tackle some tasks with tax agencies. Additionally, proof of signatures can make a remarkable difference in disputes, litigation and audits.

- Purging

Some accounting and payroll records need to be stored for specific periods as determined by the IRS and other agencies. You can use software to purge documents automatically when they reach the end of their lifespans. Advanced purging tools are also important in jurisdictions where customers have a right to be forgotten.

- Automation

Doing everything manually is no less tedious when doing it on an electronic device vs. by paper. Automation can ensure each new document gets routed to the correct folder. It can also generate analytics that managers need to make informed decisions. Additionally, automation provides an excellent solution for simplifying document purging.

Why Is Financial Document Automation and Management Important?

Document management plays a crucial role in accounting, especially in financial institutions. These are some of the factors that make it increasingly important in the modern world.

- Efficiency

Accountants and the procurement team spend much of their workdays tackling time-consuming and repetitive tasks related to document management and procurement documents project management. Automation can go a long way toward reducing this wasted time.

- Agility

When companies migrate to digital platforms and cloud computing, it makes it easier to pivot when external or internal factors call for it. It also makes it easier to move some functions out of the office. For example, managers and some financial professionals can work from home.

- Compliance

Financial professionals do need to meet requirements for documentation. Specific industries, such as health and wealth management, also have additional documentation requirements that the right software can handle with ease.

- Cybersecurity

Organizations of all sizes face cybersecurity risks. In fact, Statista estimates that the global average cost of a data breach across all major industries was roughly $4.2 million in 2021. Document management software provides the high protection levels companies need to block unauthorized access.

- Legal Protection

When businesses have disputes with customers, vendors, partners or employees, litigation becomes likely. Proper documentation makes it easier for a company to defend itself in negotiations and during court proceedings.

- Informed Decisions

When opportunities arise, managers often have a small window of time to seize them. Having immediate access to financial records makes it easier to determine cash flow, debt level and other important factors that influence the feasibility of moving forward.

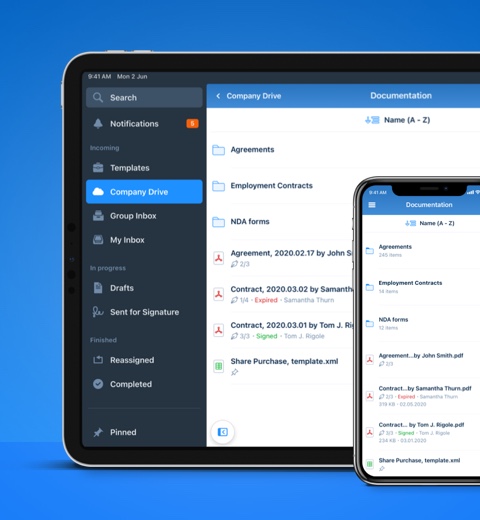

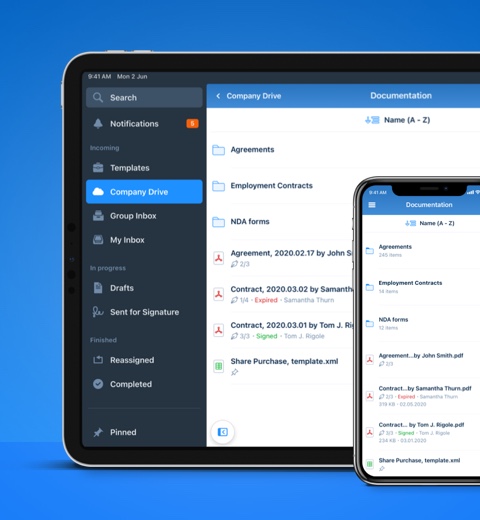

How Can Fluix Simplify Document Management for Accounting?

Over the past few years, our engineers have worked hard to perfect our document management system. We serve a lot of industries and fields and have become a favorite among accountants. These are some of the many features we provide that could benefit your accounting team:

- Workflow Automation: Use Fluix to eliminate boring, tedious and repetitive tasks.

- Collaborations and Approvals: Leverage cloud features to simplify the collaboration and approval process from anywhere in the world.

- Training Management: Easily manage, monitor and facilitate the training process.

- Digital transformation: Centralize your data storage in the cloud and go paper-free.

- e-Sign: Collect electronic signatures from workers, customers, business partners and vendors.

- Audit and Compliance: Simplify the process of ensuring compliance with OH&S, HIPAA and NECB requirements.

Would you like to try our software for yourself? We offer a risk-free 14-day trial with no need for you to enter a credit card, and you can cancel at any time. Our plans start as low as $20 per month. Try it today.