What Is CapEx?

Capital expenditure (CapEx) is the money used to purchase long-term assets that will provide at least one year’s benefit to a business.

These investments keep the company running or help it grow. Examples of CapEx include purchasing equipment, furniture, and property; acquiring patents and technology; and making improvements to current facilities.

CapEx is made using either cash or credit. These purchases are listed as company assets and their value is depreciated over time for tax purposes.

What Does the CapEx Approval Process Look Like?

The CapEx approval process helps companies decide if big purchases are worthwhile.

Most companies require multiple authorizations to approve capital expenditures, or at least those over a certain dollar amount. This system helps prevent fraud and unnecessary purchases.

It starts off when a person or team submits a CapEx Request Form. From there, the request usually goes through many departments on its way to the CFO. Once the CFO receives it, they take a close look and make the final call on whether to approve the purchase.

Who Is Involved in CapEx Approval?

While every company has its own process, these are the people typically involved in CapEx approval:

- Department Initiator(s): The person or team who spots the need for a major purchase and submits the request.

- Department Approver(s): The department heads who review the request and decide whether it moves to the next approval stage.

- Finance Team: The team who checks the cost, evaluates the ROI, confirms if there’s room in the budget, and manages financial document management.

- Senior Management: The executives or directors who make sure the purchase aligns with the company’s strategy and give final approval.

- Procurement Team: The team who are responsible for finding vendors, negotiating deals, and completing the purchase.

Depending on the type of capital expenditure, the legal team and risk management team might also be involved.

Simplify Your CapEx Approval Process with Fluix: Start Automating Today

CapEx Approval Process Steps

Here’s how the CapEx approval process usually unfolds:

Step 1: Initial Request

A department realizes they need to make a big purchase, like for new equipment, facility improvements, or software. They submit a formal request that explains:

- What they’re asking for

- Why it’s important

- How it will benefit the company

This request launches the approval process.

Step 2: Departmental Reviews

The request is then passed to the relevant departments for review. For example:

- If it’s a software purchase, the IT team should check if it’s compatible with the tools they already use.

- If there are compliance considerations, that team should weigh in too.

Department heads make sure the request fits the team’s needs and supports their objectives.

Step 3: Financial Scrutiny

Next, it’s time for the finance team to dig into the details. They’ll look at the numbers and consider things like:

- Will the investment deliver a strong ROI?

- Does the operating budget have room to accommodate the request?

- Is this the right time to make the purchase?

They’re responsible for checking whether the capital expense is worthwhile and if it’ll cause financial strain for the company.

Step 4: Decision Time

Once the financial team has weighed in, the request passes along to senior management for final review. Here, the request is either:

- Approved: If everything checks out, the purchase gets the go-ahead and moves to the next stage.

- Denied: If it doesn’t meet the criteria, the request may be sent back for revisions or turned down entirely.

Step 5: Procurement and Implementation

The procurement stage begins if the request is approved. This involves finding vendors, negotiating prices, and making the purchase. Many companies use procurement management software here to streamline these tasks.

The item or service is passed to the team that requested it once the purchase has been made.

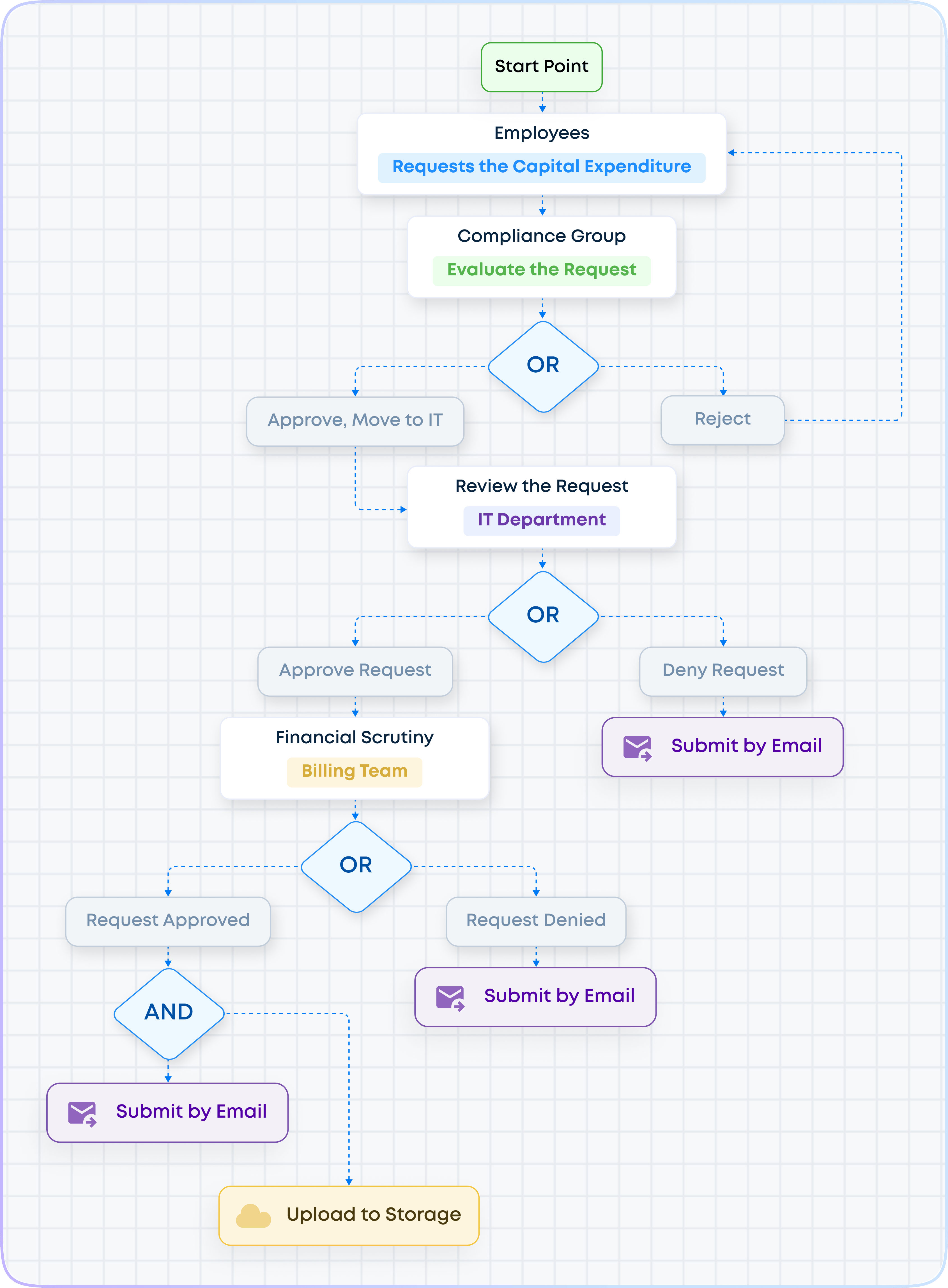

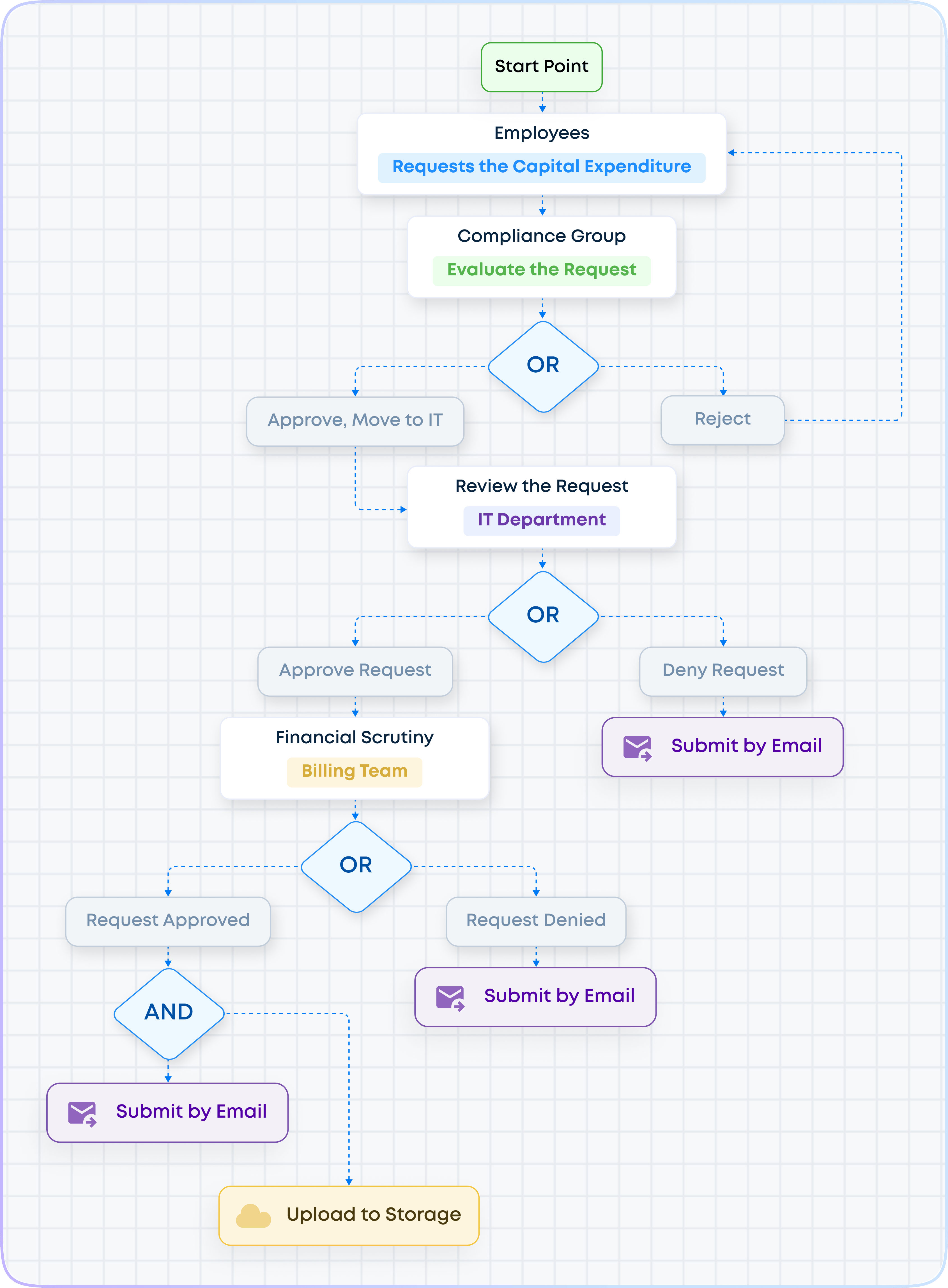

CapEx Approval Flowchart

Every company has its own procedure to follow. However, most include common steps. Let’s map a typical CapEx process flowchart:

- An employee identifies an out-of-the-ordinary need that requires funds.

- A solution is found.

- A report is put together, outlining how much it costs, the projected return on investment, the justification for the purchase

- Department heads, the finance team, and senior management assess the CapEx request and determine if the company will approve the expenditure.

- Key personnel reject the proposal or sign the approval

If approved, the procurement process is launched.

Although this can be accomplished manually, it shouldn’t be. Here’s why manual processing is a bad idea:

- Human error can cause delays. The more people involved in handling a request, the greater chance for mistakes.

- While companies may have procedures and guidelines for CapEx, enforcing them is difficult without a centralized system or oversight.

- Every mistake adds extra work, from missed deadlines to misinformation, costing even more time to fix.

This is where automation makes all the difference. Automating your CapEx workflows will save you time and money by ensuring the entire process runs smoothly. Automated steps and real-time oversight mean feature mistakes and faster approvals.

To cover aspects of the CapEx approval process, we recommend using these templates:

How to Optimise the CapEx Approval Process

After years of sticking to the same routine, it’s easy to assume your process is as good as it could be. But with a 5 simple steps to your capital expenditure approval process, you could make things run more efficiently.

- Set the foundation with a clear policy. Start by making sure that your CapEx approval policy is clear and easy for everyone to follow. Spell out exactly what’s required for approval and which teams handle each step. Provide user-friendly CapEx templates to guide teams and ensure consistency in submissions.

- Keep everything in one place. No one likes chasing updates. Use a centralized system to store all CapEx requests, updates, and past decisions. This way, everyone can see where things stand, check the status of their requests, and give feedback if something’s unclear. When everything is in one place, it’s easier to stay organized and avoid delays.

- Track what’s working (and what’s not). You can’t fix what you don’t measure. Track approval times, identify where requests are getting held up, and look for patterns. Use that data to improve the process, remove bottlenecks, and keep requests moving forward smoothly.

- Allow for urgent requests and changes. Sometimes approvals can’t wait. Build a fast-track option for time-sensitive requests, but make sure the important checks are still in place. Also, have a plan for handling changes in project budgets or scopes to prevent delays from unexpected adjustments.

- CapEx tools. Software plays an important role in CapEx approval optimisation. Digital procurement tools centralize paperwork, automate steps, and make it easy to track requests. It’s a simple way to streamline the process, improving efficiency for both initiators and approvers.

The Capital Expenditure Process with Fluix

Financial decisions require a reliable process, and digital tools like Fluix provide the control and oversight needed to manage it all with confidence and precision.

With Fluix, you can design and automate CapEx workflows, ensuring every step is mapped out clearly in flowcharts. Automated approvals will speed up each step by instantly moving requests forward.

Our real-time dashboards will give you complete visibility into where requests stand, who’s handling them, and what’s needed to move forward. No more chasing updates or wondering if something’s missing.

And after the process is complete, Fluix retains a record of each step. That record is useful for seeing if your process works well or if there’s room for improvement. Plus, future requesters can review past CapEx records to understand how your company handles these expenditures, making it a valuable training tool.

By combining automation and transparency, Fluix will help you take control of your CapEx approvals. It’s a faster, smarter way to manage important decisions without losing accuracy or accountability.